With November upon us, thoughts turn to the upcoming holiday season. Visions of a table groaning under a plump turkey, stuffing, cranberry sauce, and pumpkin pie have many of us counting the days until Thanksgiving. But this year, ongoing supply chain issues could threaten the festivities with increased prices at Thanksgiving and Christmas. It would be wise to begin all your holiday shopping extra early to avoid disappointments.

On a much brighter note, the stock market has continued to do well and shows no signs of retreat. The year-to-date S&P return as of October 25 was 21.6%. Several factors suggest that the market could continue its current path through at least year-end. The fourth quarter is typically the market’s strongest quarter of the year. A declining rate of new COVID infections should have a positive impact, while a tight labor market and the spate of employees resigning their positions also signal a strengthening economy. However, inflation remains more stubborn than anticipated, and in November the Fed has indicated that it will begin to taper their monthly bond repurchases. The Fed seems to be moving away from the earlier supposition that inflation would be transitory and may consider interest rate increases in 2022. This could create market volatility, at least in the short term. The Fed has telegraphed these changes well in advance, precisely to try and mitigate uncertainty and volatility.

Articles of Interest

As Investors, Millennials Haven’t Had it Easy…

Between seemingly endless market tumult, and potentially insurmountable debt, many Millennials have developed a skeptical view of investing.

Learn More

As Investors, Millennials Haven’t Had it Easy…

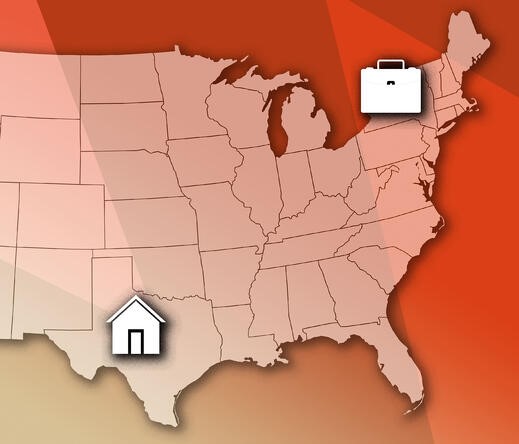

Living in one state and working in another can trigger a number of tax issues. Here are several things to keep in mind if you or your spouse are in this situation.

Learn More

When it’s Value vs. Growth, History is on Value’s Side

There is pervasive historical evidence of value stocks outperforming growth stocks. Data covering nearly a century in the US, and nearly five decades of market data outside the US, support the notion that value stocks—those with lower relative prices—have higher expected returns.

Learn More

The 69 Best Thanksgiving Recipes

Let go of all that menu-making stress and leave choosing the perfect Thanksgiving recipes to us.

Learn More

Advisory services offered through KCPAG Financial Advisors LLC and insurance services offered through KCPAG Insurance Services LLC, subsidiaries of Kemper Capital Management LLC. Tax services offered through Kemper CPA Group LLP.

Symmetry Partners, LLC, is an investment advisory firm registered with the Securities and Exchange Commission. The firm only transacts business in states where it is properly registered, or excluded or exempt from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission.

No one should assume that future performance of any specific investment, investment strategy, product, or non-investment related content made reference to directly or indirectly in this newsletter will be profitable. You should not assume any discussion or information contained in this email serves as the receipt of, or as a substitute for, personalized investment advice. As with any investment strategy, there is the possibility of profitability as well as loss. Symmetry does not provide tax or legal advice and nothing either stated or implied here should be inferred as providing such advice. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions.

Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the occurrence of which would have the effect of decreasing historical performance results. Actual performance for client accounts will differ from index performance.

S&P 500 Index represents the 500 leading U.S. companies, approximately 80% of the total U.S. market capitalization.